By Sampath Dissanayake

Covid-19 behavioural changes: Purchasing of selected product items

13 May 2020

As you know, the COVID-19 pandemic has negatively impacted the economic, social, political, religious and financial stability of our Country as well as the world. To control the COVID-19 contamination, countries had to lockdown either completely or in sections and as a result, peoples life styles completely changed. They were asked to safe-distance themselves as per instructions given by the health sector.

Survey Research Lanka (SRL), a responsible research and consultancy company has executed an all island study to get an understanding of the pandemics impact on the behaviour of the Sri Lankan Consumer with the objective of assisting decision makers who seek data on the current situation.

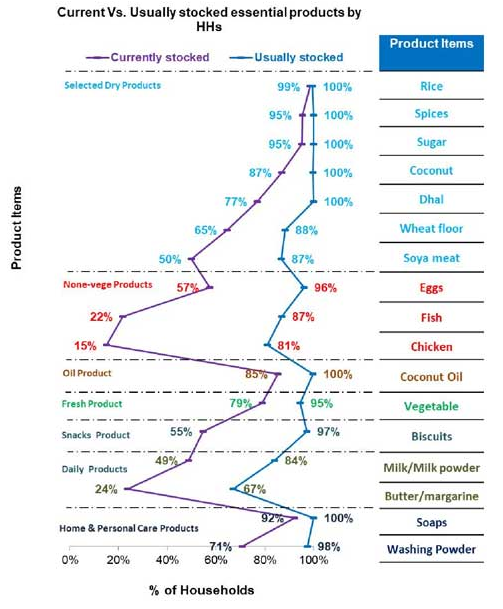

The focus of the study was to understand any gaps of selected product items, stocking pattern of consumers in the country and how it changed from its usual patterns.

This was an all island representative study which was conducted among a randomly -selected sample of 403 households, which ensures a statistical validity of a 95% Confidence level (CL) with a 5% Margin of Error (MoE). The interviews were conducted among housewives and providers of selected households.

The database stored countrywide information of provinces, ethnicities and social economic classes. The sample covered all nine provinces based on proportionate to population and all social economic class categories; upper, Upper middle, lower & lower middle.

Further, a robust sample representation was maintained for areas where a continuous lockdown was executed Vs. areas where curfew was relaxed on random days.

The data collection was done using a structured questionnaire to understand;

– The current stocking pattern of 17 selected product items at homes.

– Each items stock requirement – the number of days the item was stocked.

– The items stock requirement during a normal period.

The data collection was conducted via telephone using a CATI script (Computer Aided Telephonic Interview script) and data collection was done on 18 and 19 of April 2020.

Key findings & generated insights;

Currently, rice is available in almost all households as on any usual day. Although, an average household generally stocks rice for two weeks, the study found the average household to currently stock rice quantities sufficient for an average of 10 days.

As a result of the lockdown, spices and sugar was not available and was temporally out of stock in 5% of the households during the pandemic and the corresponding unavailability/out of stock figures for coconut, dhal, wheat flour and soya meat are 13%, 23%, 13% and 37% respectively.

Spices are generally stocked on an average requirement of 19 days and now during the pandemic it’s reduced to 12 days. It is also possible the lack of availability of spices such as turmeric might be the reason for this behavioral change currently. In general, sugar is stocked for an average of 14 days and it has been currently reduced to 8 days.

Similarly, the average number of days where coconut, dhal, wheat flour and soya meat are stocked has also decreased during the pandemic. After the Government introduced the controlled price, the demand for dhal significantly increased, but the supply was not sufficient to fulfil the demand and therefore the product was not available in most places.

Retailers and wholesalers had to limit the number of dhal kilos issued to an individual. This might have also impacted the above situation.

When it comes to non-veg products, around 5-6 out of 10 households stock eggs while around 2 out of 10 households only stocks fish, and a lesser number of households stock chicken. The stocking pattern of non-veg items shows a drastic change from their usual consumption patterns, this could be due to unavailability and freshness related concerns.

Although a drastic shift in the number of households who purchase these non-vege product items in pandemic was witnessed, those who stock fish and chicken seem to be stocking for their usually required number of days, that is usually an average household stock these non-vege product items for 4-5 days requirement which seem to be continuing unchanged.

This indicates that households which have a high requirement of fish and chicken consumption/ hardcore (as a must product item for the household) consumers seem to be continuing to buy these product for the same number of required days as any other usual time period.

When around 2 out of 10 households purchase and stock fish and chicken in this pandemic as essential other 8 households are learning to live without meat and sea food or rather deprioritising them at the moment.

Even though this trend of chicken and fish consumption in the pandemic could have impacted to increase purchase of soya meat, survey data doesn’t indicate such an impact. Although, the product list used for the study doesn’t cover canned fish/tin fish, it can be hypothesised that some impact could have been seen in canned fish/tin fish purchase pattern. Nevertheless, this trend creates great market and marketing opportunities for marketers and brands in meat and sea food categories as well as in substitute categories.

Even though coconut oil is an essential product, it was found that around 15% of the study covered households don’t have coconut oil at the moment. Even though coconut oil is available in 85% of households, the current stock of coconut oil is sufficient only for 9 days which is stocked for 13 days in general.

For vegetables, about 15% difference could be seen in currently stocked and usually stocked and the average numbers of days which vegetables are stocked are more or less the same in generally as well as during the pandemic.

The only snack product category that was considered in this study is the biscuit, which is one of the highest reached product categories in the country. It is bought only by 55% households currently. Further, during the pandemic period, biscuit quantity purchased also has decreased.

In the case of selected daily products, availability of milk/FCMP (Full Cream Milk Powder) and butter/margarine in households has decreased significantly during the pandemic, current stocks of milk/FCMP and butter/margarine are less than their usual stocking patterns. According to the available consumers’ data with SRL, consumption of FCMP showed a downward trend during last couple of months as there is a negative perception for FCMP in the society.

Further, around 27% difference could be identified in current stocking patterns of Washing Powder over their usual stocking patterns. However, soap penetration (penetration is defined as percentage of households purchase the category), is held at a higher level like 92% this period when compared to 100% penetration in usual times. General pattern of stocking washing powder and soap is for around 16 days which has dropped to 10-12 days in this pandemic.

All these facts and figures depict a certain level of behavioural change during the COVID-19 pandemic. Further, unavailability, poor purchasing power, difficulty in accessing PoS (Point of sales) or purchase channels can be identified as main reasons for decreasing category penetration, quantity purchased and the frequency of purchase of the above selected product items.

Other than that, data shows that panic situation that experienced at the start of the pandemic period has become normal and there is a hope among people for a new normal time soon and hence do not observe panic stocking.

If this phenomena change back to normal after curfew/ pandemic period, all elements of supply chain management including research & development, production, packaging, SKUs, distribution, sales and marketing need to be re-looked at and all the businesses should be ready with contingency plans to prepare themselves to face the future with the best strategic plans. The plans should be created now and start execution without further delay. A vast number of factors would impact consumer behaviour, perception, their choices and expectation more than any other time.

Careful and close analysis of such trends and nuance level understanding should be the key KPI (Key Performance Indicator) of marketers and brand owners in this pandemic. Intuitive marketing (based on gut feel) is not recommended but fact based decision making would be the winning point for small to large scale companies across all the sectors and categories.

Do not expect it to be normal anymore; it is going to be New Normal. Are you ready for that New Normal world!

Wishing all Sri Lankan a soon recovery and heartiest gratitude to all heroes in the healthcare sector, three forces and police…!!!(The writer is a Senior Research Manager, Survey Research Lanka (Pvt) Ltd (SRL is the first Sri Lankan full service independent marketing and social research Consultancy Company).He can be contacted on sampath@srl.lk

COVID -19 LIVE TRACKER

Total Cases | |

Total Recovered | |

Total Deaths | |

% of Deaths |