Nearly 58% of the employed Sri Lankans are earning low wages in poor working conditions in informal employment and 52% of the working Sri Lankans belong to the rural households of Sri Lanka in 2017. If Sri Lanka’s economy is to continue to expand into higher value added sectors and reduce poverty, it needs to become more efficiently driven. An empirical investigation on Productivity, Innovation and Growth in Sri Lanka, cite that access to skilled labour is one of the key dependent factors for increasing productivity and innovation leading to growth in Sri Lanka. Thus major skills shortages and mismatches appear to be holding back the country’s development efforts.

PUBLISHED IN 2019

ASSESSMENT OF SKILL DEMAND NEEDS AND SKILL GAPS IN MANUFACTURING AND ENGINEERING SERVICES SECTOR IN SRI LANKA

RESEARCH REPORT BY SRL PVT LTD

Summary

The study focuses on detailing the skill needs and skill gaps in 3 sectors of Manufacturing and Engineering service sector in Sri Lanka, namely Rubber & Plastic industry, Metal related industry and Engineering service sector.

To accomplish the objectives of the study, a comprehensive research was carried out using a mixed research approach which consisted of both secondary and primary data analysis.

The overall study findings revealed that all three selected industries equally experience the poor quality and quantity of skills as critical concern. The gap in the quantity of skilled employees seems to be the burning issue expecting immediate solutions. Hence the study revealed the following;

As per the latest updated statistics available at TVEC, 3 forces(Navy, Army & Air Force) , CEB training center, a total of 17,066 students passed out in the 2018 after having completed courses that are related to Rubber & Plastic, Metal & Engineering Service-related sectors. The skilled employees’ requirement for the three industries is estimated to be at 42,362 per annum. In addition to this, annual departure for foreign employment related to these industries in a year estimated to be 10,000 (Sri Lanka Bureau of Foreign Employment). Therefore, the total estimated demand is at 52,363 whilst the total supply is only 17,066 per annum which creates a gap of 35,296.

Mechanical and maintenance engineering technicians, is the highest demanded category in the country, ‘technicians – general’ is the category with highest departure for foreign employment in a year. The highest passed out batch in 2018 consist of ‘Mechanic (Other Machinery)’, whereas the highest demand is for ‘Mechanical and maintenance engineering technicians’ (56% of the total required cadre) while the highest annual departure category is also ‘technician-general’.

Considering the very low supply of the Rubber and Plastic industry related skilled employees currently, the total skilled cadre required to fill the existing gap would be approx.2,919 per annum skilled employees. ‘Tyre making and vulcanizing machine operators’ is the highest demanded skilled category occupation in the Rubber & Plastic Industry. This is followed by ‘Factory worker – Rubber’, ‘Latex Product Operator’, ‘Factory worker – Plastic’, ‘Plastic Extrusion’ and ‘Plastic Bottle/cup blowing machine operators’.

The estimated skilled employees’ gap for Metal related industry and Engineering service sector is 32,377 after considering the current supply. The highest demanded skilled job category for Metal industry is ‘Welders and Flame cutters’ followed by ‘Aluminum fabricators’. For Engineering service sector ‘Mechanical and Maintenance Engineering technicians’ are the highest demanded skilled job, followed by ‘Electrical Engineering technicians’, ‘Welders’, ‘Refrigeration and Air Conditioning technicians’.

Many companies are tabling the existing skills requirement in the market when questioning about the emerging skills but not necessarily very new talents that they foresee as future needs. This is because the existing skill requirements are very challenging to source, hence they mention it as emerging skills. The highlighted emerging skills requirements are; ‘Injection Moulding Machine Operators’, ‘Packers’, ‘Plastic Cutting’, ‘UPVC /Aluminium Welders’, ‘Lathe & Milling Machine Operators’, ‘CNC Machine Operators’, ‘Elevators’ , ‘Electricians’, ‘Technicians’, ‘Welders and Macaronic Engineering’, ‘Pipe Fitters’, ‘Electricians, Steel Modification’, ‘Cutters and Welders’, ‘Lathe & Milling Machine Operators’, ‘Industrial Engineering’, ‘Research & Development and Innovation’ ‘Multi-skilled Craftsman’, ‘Skilled Workers with smart technology’.

As an immediate solution to the scarcity of skilled workforce, companies tend to recruit unskilled employees and train them on the job. Although the companies’ expectation is to train them and sustain them in the company, from candidates’ side it was just a stop gap filler for them. It would have not been their desired destination to have a career in the industrial sector. Therefore, retention of such recruits is always challenged. Recruits from vocational training centers also tend to leave once they start experiencing the job, and the key reasons for this trend are; working environment, lack of comfort in the work place like odd odors in the factory (Rubber and plastic) and non-ac environment, unwillingness to work long hours, lack of fitment to the job or the industry (attitude). Further, poor pay and other benefits, prioritizing recruiting from adjacent areas, employers prioritizing recruiting unmarried people also contribute to the same.

People’s ‘preference towards white collar jobs as opposed to blue collar jobs’, ‘Higher salary expectations without having the right skills, experience and/or qualifications by candidates’, ‘not comfortable with the working environment due to the sound, smell and noise’, ‘youth seek for easy money through convenient jobs such as riding three wheelers’ and ‘the inability to stick to one job’ – lack of endurance are other attitudinal and societal trends cause the skills gap in the market from companies point of view.

Objectives

the overall objective is to improve the quality, relevance and accessibility of skill training provision in Sri Lanka. The objective and outcomes are to be achieved through the implementation of 5 interrelated strategies including;

-

Improving quality

-

Improving relevance

-

Improving access

-

Improving recognition for vocational training

-

Introducing supportive policies, systems and structures

By considering importance and contribution of different industries, MESSCO has identified three sectors namely Rubber and Plastic Industry, Engineering Services (Electrical, Electronics & Telecommunications), and Metal Industry as priority areas to be supported under the SSDP interventions.

Objective

Objective

Objective

Methodology

following factors were considered in deciding a rigorous and pragmatic research approach.

The target group –Two target groups were considered for this study;

-

The first target group was senior managers /owners / Human Resource Managers of selected companies.

-

The second target group was the senior level officials in training institutes

Having unstructured conversations using research materials which has both open ended and close ended questions were identified as an important consideration when deciding on the research approach. Therefore, both Qualitative and Quantitative research methodologies and techniques were used in this study. Further, having a thorough knowledge on industry skill demand and supply trends was a significant part of the study and hence literature review via a desk research was conducted in this study. As a result, it was a mixed research approach applied for this study which consisted of a desk research, qualitative one to one discussions and quantitative face to face interviews.

Sample size of a study like this is a critical factor to be considered at the design stage. When deciding on the sample size 2 critical factors were considered;

- While confidence level and margin of error are the factors deciding the sample size, allocated investment was also taken into consideration, but still ensured minimum sample requirement that should be covered in order to represent each industry.

- The recommended sampling technique for the study was stratified random sampling to ensure representation of important strata such as Small, Medium, Large enterprises. However in the absence of the database of companies that were classified under these strata, purposive sampling technique was applied for this study, where the companies who had given approval to access data were included in this study. Nevertheless, the representation of strata was ensured.

Geographical coverage of the sample spread was guided by the manufacturing establishment distribution provided by the census and statistics department (manufacturing establishment registered with the ministry of industries and the state-owned industrial establishment). Accordingly, it assured that more than 60% industry related companies are concentrated in Western province. Therefore, the sample coverage was ensured from Western Province and other part of the country approximately 70:30 respectively.

The definition of micro, small, medium and large scale companies used for this study was borrowed from Asia Development Bank definitions. Accordingly, the companies with 200 or more employees were defined as large scale, companies with 26 to 199 employees were categorized as medium scale, companies with 5- 25 employees were defined as small scale and companies with less than 5 employees were defined as micro scale. Except for metal related industries where all four segments of businesses were covered, MESSCO decided to cover only small, medium and large scale companies under Rubber & Plastic industry and Engineering services.

Rubber & Plastic industry

Metal related industry

Engineering Service sector

The Desk research was executed at the prelude stage mainly to gather data and statistics regarding trends of selected 3 industries and its contribution to the country’s Economic growth. The desk research was completed with the macro view of the country’s Economic trends and significance of the role that should be played by Rubber & Plastic, Metal related and Engineering Services industries. Therefore, both unpublished and published policy documents and administrative reports, related recent newspaper articles were referred for the desk review. As one of the key objectives of the desk research was to gain an understanding of skill supply side trends in the country, most of the data sources referred were obtained from vocational training institutes.

Due to lack of published data with most updated trends in the industry, the researcher interviewed following institutes and authorities to fill data gaps;

- Sri Lanka Bureau of Foreign Employment

- The Plastic & Rubber Institute of Sri Lanka

- NAITA – National Apprentice and Industry Training Authority

- DTET – Department of technical and Education Training

- VTA – Vocational Training Authority

- NYSC – National Youth Service Council

- Urban Council and Pradeshiya Sabha

Key Informant Interviews (KIIs) were conducted among seniors in following listed institutes at this phase. The objective of this phase was to gather skill gap measuring parameters and variables that should be quantified at the quantitative stage. Parameters including, the contribution of the industries to the country development and economy, occupation categories that exist in the three industries currently and their importance level to the industries, emerging skilled occupation categories that they perceive to be which are critical to meet future industry requirements, industry experts and training providers perspectives on issues faced by the three selected industries with regard to skilled and unskilled employees. Other than that these discussions were helpful to understand some of the very relevant data sources that should be approached by the researcher to enhance the desk review and the sample frame of the quantitative phase of the study.

Accordingly, senior level officials from the following industry related bodies and training institutes were interviewed under this stage;

- The Ministry of Industrial and Commerce

- The Plastic & Rubber Institute of Sri Lanka

- IESL – Institution of Engineers Sri Lanka

- IIESL – Institute of Incorporated Engineers of Sri Lanka

- Foundry Development and Services Institute

- University of Moratuwa

- NAITA – National Apprentice and Industry Training Authority

- Ceylon Electricity Board Training Centre-Piliyandala

- DTET – Department of Technical and Education Training

- VTA – Vocational Training Authority

- NYSC – National Youth Services Council

- TVEC – Tertiary Vocational Education Commission

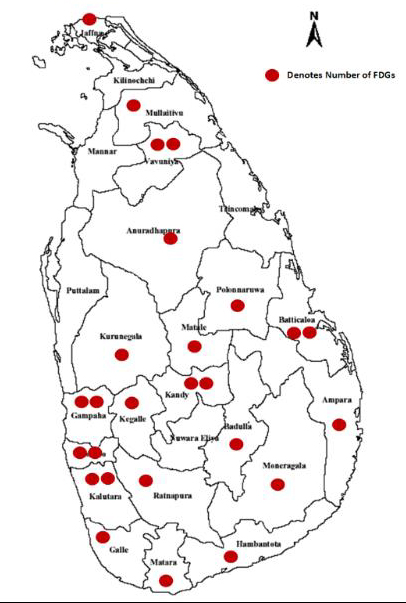

The FGD’s were planned to carry out in all 25 districts in order to capture insights of citizens Island wide. However, there weren’t any database of information applicants could be sourced from few districts; Puttalam, Killinochchi and Nuwara Eliya, Therefore, finally achieved 26 FGDs coverage is presented as follows

The main objective of quantitative study was to quantify the skill gap in the three selected industries. Therefore, employers of Rubber & Plastic, Metal related and Engineering Services were covered in this study. Human Resource Managers, Managers or Company Owners from the selected employers or companies were interviewed.

The sample coverage during the quantitative phase is 252 companies including 62 Rubber and Plastic Sector companies, 61 from the Engineering services and 129 Metal related industries.

Majority of the companies classified under the selected three industries are located in the BOI zones namely, Biyagama, Homagama, Kalutara, Ekkala, Galigamuwa, and Kundasala and hence it was covered.

A semi-structured questionnaire developed using the results of desk review and qualitative phase as a quantitative data collection tool. To validate the research tool, 13 companies were interviewed in a pilot phase before commencement of the main interview phase of the study. The findings of the pilot interviews were analyzed and discussed with MESSCO and preceded with the main phase. Required amendments to the research tool were incorporated for the main data collection phase.

The interviews were conducted in the most convenient language to the respondent; hence the research material was prepared in relevant languages. Experienced senior level researchers conducted interviews, to enable capturing any emerging topics that are relevant to this research at the discussion stage. As a result, other than the quantitative data that was covered, there were many vital qualitative data which was captured under this phase.

To make the interview process productive, the approval letters that was provided by MESSCO was used in order to get access to data and for interviews with companies.

As two key quality control measures, the business cards of the companies were collected by the researcher wherever it was available and there was a call back process to approve the authenticity of the final interviews before it was taken for data processing. At the data processing stage, logic checks were executed before data was taken for analysis. The analysis was carried out using the Statistical Package for Social Science (SPSS). Main data analysis variables considered for the study were;

- Overall Manufacturing and Engineering Service sector level

- By each industry level – Rubber and Plastic industry, Metal related industry and Engineering service sector.

- The scale of the companies within industries –Micro & small, medium and large scale companies.

Research Process

It was planned to apply stratified random method to ensure representative coverage of micro, small, medium, large scale companies in each industry. Due to unavailability of the universe size by these stratums, purposive sampling was applied to select the sample. Further, some of the selected companies did not allow access data or for interviews, hence companies who were willing to contribute for the study with adequate data and time for the interview was covered in the sample. Therefore, the study findings will be limited to make directional conclusions. In order to make precise conclusions with regard to the entire industry based on this study’s findings, industry experts’ consultation will be required.

Representation of micro, small, medium and large scale companies were covered in the sample to make the overall industry level inferences. In consultation with MESSCO, this study covered small, medium and large scale of Rubber and Plastic industry and Engineering Services and micro, small, medium and large of Metal related industries.

Lack of secondary data to assess the universe size of micro, small, medium, and large scale companies of the industry was a challenge. Therefore, the sample breakdown by these strata was done purposively and hence proportionate to population representation was not assured in the study. This is considered as a limitation of the study when extrapolating the findings in to the universe at the analysis stage.

While skill requirement for industries are supplied by private sector institutes, government sector institutes and NGOs as well, skill supply has been measured in this study considering the database of student number completed their related courses at NAITA, DTET, VTA, MPMA, NIBM, SLIOP, UC, NYC, Sri Lanka Institute of Textile & Apparel, Ocean University of Sri Lanka, NYSC, UoVT – Ratmalana as of TVEC. Other than these sources, skill supply estimates gathered via interviews from the three forces and CEB training Centre was also used for skill gap estimation. The supply estimates gathered from interviews is considered as a limitation due to unavailability of supportive documents to confirm the estimate for its error level.

The study was conducted from May to August 2019 time period which was immediately after the Easter Sunday attack. This was a commercially sensitive time period for businesses and hence businesses confidence was very low. The growth plans and any future hiring requirements or most importantly emerging skill requirements was not very clear due to the uncertainty they operated in. Although, they probably had growth plans and had identified emerging skills internally, the majority of them were reluctant to reveal at the interviews. This was a barrier for the researcher to identify and diagnose future skill requirements and emerging skills for industries, hence limited analysis on future trends.